If you agreed to a direct debit, your vehicle tax payment will then be automatically debited from your bank account as a lump sum. Vehicle tax in Germany is always paid one year in advance. If you haven't taken a direct debit, you need to transfer the money on time every year – you will not receive a reminder.Goods intended for commercial or trading purposes must always be declared regardless of their value. This also applies to goods subject to restrictions (e.g. narcotics, weapons, ammunition and protected plant and animal species, parts thereof or goods produced using such species).In Germany, every driver pays an annual car use tax (known as Kraftfahrzeugsteuer), which is approximately €100. In addition, when buying a new or used car in Germany, you must be aware that a VAT of 19% is applicable.

Do you have to pay road tax in Germany : You must pay a vehicle tax (Kraftfahrzeugsteuer) every year. For most cars, it costs around 100€ per year. For motorcycles, it costs around 50€ per year. The maximum amount is around 375€ per year.

Do you need to pay road tax in Germany

If you own a car in Germany, you must pay a vehicle tax (Kraftfahrzeugsteuer or Kfz-Steuer) every year. The cost depends on the type of the vehicle, and the size of its engine.

How much are customs charges in Germany : The flat rate of duty is set at 17.5 percent of the product value. A reduced rate of only 15 percent ad valorem is charged on goods for which specific tariff concessions – known as preferences – have been granted. Also, for certain goods special flat rates of duty shall be applied.

Customs Duties and Taxes on Imports

Duties range from 0-17%, with the general tariff averaging 4.2%. 10%

Depending on the vehicle, customs duties may apply initially. These usually amount to 10% of the purchase price of the vehicle. The customs duties are then taxed at 19% German VAT.

How much is import tax on a car to Germany

Importing a car from outside the EU. A car or other motor vehicle imported to Germany from outside the EU is normally subject to a 10% import duty and a 19% import value added tax. (The value-added tax on imports is called import turnover tax (Einfuhrumsatzsteuer).Toll charges must be paid in Germany (called “Maut” in German) to use certain motorways and bridges. These toll charges are often collected via an electronic system, e.g. a toll sticker or an on-board unit (OBU) in the car. The system varies depending on the region and the road you are driving on.If you do not settle your tax debt, the tax office is authorised to initiate enforcement measures against you. This includes the seizure of your cash balance at banks in Germany or the seizure of your pension entitlement from German pension providers. There are no customs duties to be paid when buying goods coming from within the European Union.

How do I pay customs duty online : Let's get started visit cbicp.isgate.gov.in. The official ice gate portal and login to proceed. Select from the list of unpaid challans. And click on pay note.

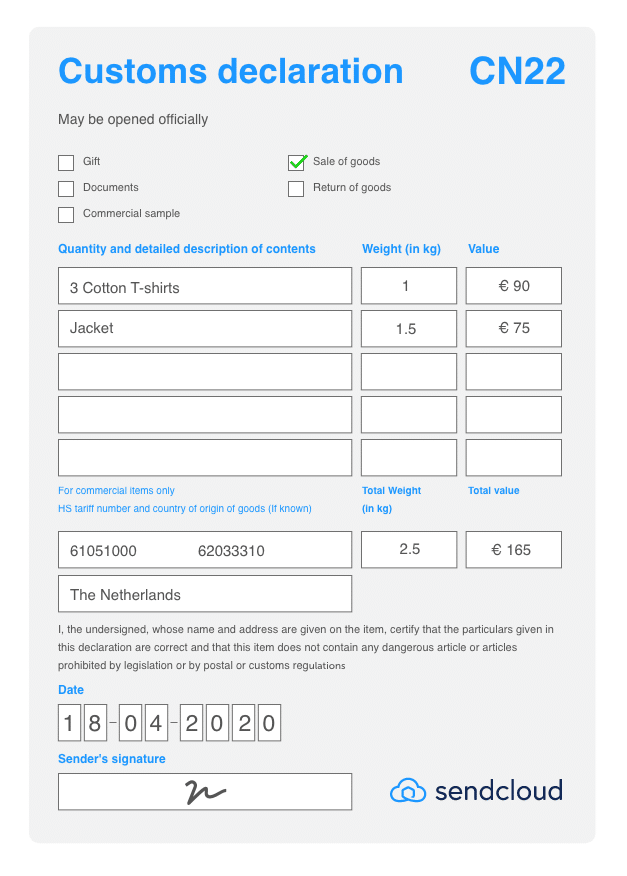

Do I have to pay customs for package to Germany : Germany Import Tax & Custom Fees

There are usually also charges levied by the import customs broker for filing the import customs clearance documents with the local customs authorities. This customs brokerage fee will be in addition to the customs duties and import VAT / GST applied to the imported goods.

How much is customs duty in Germany

The flat rate of duty is set at 17.5 percent of the product value. A reduced rate of only 15 percent ad valorem is charged on goods for which specific tariff concessions – known as preferences – have been granted. Also, for certain goods special flat rates of duty shall be applied. Value of goods up to €150

For a value of up to 150 euro, the consignments are duty-free, but import turnover tax of 19 per cent or 7 per cent and excise duty (for consignments of goods subject to excise duty) must be levied. However, duties of less than 1 euro are not levied.We have good news for all those who are planning to travel to Germany. Highways in this country are free for passenger cars, motorcycles and trucks with a GVW of up to 7.5 tons.

Where can I buy a German vignette : Buy your e-vignette at mautwelt.de and just start driving. The e-vignette is the easiest way to order your digital vignette online. Simply enter your license plate number and choose the type of vignette you need. We'll take care of the rest and send you your digital vignette by e-mail.

Antwort How do I make a customs payment? Weitere Antworten – How do I pay my road tax in Germany

If you agreed to a direct debit, your vehicle tax payment will then be automatically debited from your bank account as a lump sum. Vehicle tax in Germany is always paid one year in advance. If you haven't taken a direct debit, you need to transfer the money on time every year – you will not receive a reminder.Goods intended for commercial or trading purposes must always be declared regardless of their value. This also applies to goods subject to restrictions (e.g. narcotics, weapons, ammunition and protected plant and animal species, parts thereof or goods produced using such species).In Germany, every driver pays an annual car use tax (known as Kraftfahrzeugsteuer), which is approximately €100. In addition, when buying a new or used car in Germany, you must be aware that a VAT of 19% is applicable.

Do you have to pay road tax in Germany : You must pay a vehicle tax (Kraftfahrzeugsteuer) every year. For most cars, it costs around 100€ per year. For motorcycles, it costs around 50€ per year. The maximum amount is around 375€ per year.

Do you need to pay road tax in Germany

If you own a car in Germany, you must pay a vehicle tax (Kraftfahrzeugsteuer or Kfz-Steuer) every year. The cost depends on the type of the vehicle, and the size of its engine.

How much are customs charges in Germany : The flat rate of duty is set at 17.5 percent of the product value. A reduced rate of only 15 percent ad valorem is charged on goods for which specific tariff concessions – known as preferences – have been granted. Also, for certain goods special flat rates of duty shall be applied.

Customs Duties and Taxes on Imports

Duties range from 0-17%, with the general tariff averaging 4.2%.

10%

Depending on the vehicle, customs duties may apply initially. These usually amount to 10% of the purchase price of the vehicle. The customs duties are then taxed at 19% German VAT.

How much is import tax on a car to Germany

Importing a car from outside the EU. A car or other motor vehicle imported to Germany from outside the EU is normally subject to a 10% import duty and a 19% import value added tax. (The value-added tax on imports is called import turnover tax (Einfuhrumsatzsteuer).Toll charges must be paid in Germany (called “Maut” in German) to use certain motorways and bridges. These toll charges are often collected via an electronic system, e.g. a toll sticker or an on-board unit (OBU) in the car. The system varies depending on the region and the road you are driving on.If you do not settle your tax debt, the tax office is authorised to initiate enforcement measures against you. This includes the seizure of your cash balance at banks in Germany or the seizure of your pension entitlement from German pension providers.

There are no customs duties to be paid when buying goods coming from within the European Union.

How do I pay customs duty online : Let's get started visit cbicp.isgate.gov.in. The official ice gate portal and login to proceed. Select from the list of unpaid challans. And click on pay note.

Do I have to pay customs for package to Germany : Germany Import Tax & Custom Fees

There are usually also charges levied by the import customs broker for filing the import customs clearance documents with the local customs authorities. This customs brokerage fee will be in addition to the customs duties and import VAT / GST applied to the imported goods.

How much is customs duty in Germany

The flat rate of duty is set at 17.5 percent of the product value. A reduced rate of only 15 percent ad valorem is charged on goods for which specific tariff concessions – known as preferences – have been granted. Also, for certain goods special flat rates of duty shall be applied.

Value of goods up to €150

For a value of up to 150 euro, the consignments are duty-free, but import turnover tax of 19 per cent or 7 per cent and excise duty (for consignments of goods subject to excise duty) must be levied. However, duties of less than 1 euro are not levied.We have good news for all those who are planning to travel to Germany. Highways in this country are free for passenger cars, motorcycles and trucks with a GVW of up to 7.5 tons.

Where can I buy a German vignette : Buy your e-vignette at mautwelt.de and just start driving. The e-vignette is the easiest way to order your digital vignette online. Simply enter your license plate number and choose the type of vignette you need. We'll take care of the rest and send you your digital vignette by e-mail.