In addition to fiscal policies, monetary policies are also known as demand-side policies.Fiscal policy influences the economy through government spending and taxation, typically to promote strong and sustainable growth and reduce poverty.In supply-side economics, the goal is to provide consumers with more products and service options to purchase by encouraging businesses to spend money on production and research. In contrast, demand-side economics focuses on helping consumers maximize their income by reducing taxes to spend more on goods and services.

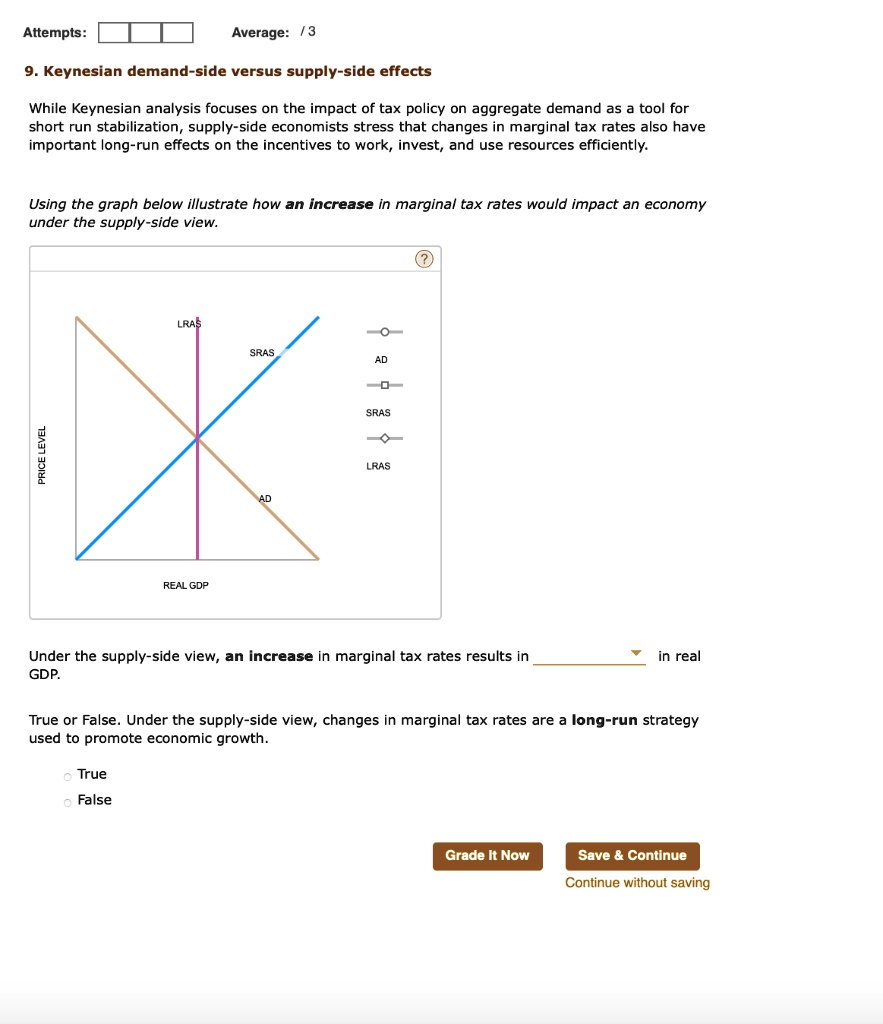

What are the differences between Keynesian and supply side fiscal policies : This is the single big distinction: a pure Keynesian believes that consumers and their demand for goods and services are key economic drivers. In contrast, a supply-sider believes that producers and their willingness to create goods and services set the pace of economic growth.

Which of the following is a supply-side fiscal policy that could

The tools that are used in the supply-side fiscal policy are the reduction of taxes and deregulation. These tools create a better environment for business since the firms that embrace them can employ more workers hence increasing production; this initiates more demand, which, in return, boosts the economy.

Which is a supply-side policy : Supply-side policies are policies that aim to increase productivity and efficiency in the economy. The objective of supply-side policies is to boost aggregate supply (AS) to result in increased output. In this case, the LRAS shifts to the right and national output levels increase, meanwhile the price level decreases.

Supply Side Policy (SSP) refers to measures governments take to increase the availability or affordability of goods and services, along with generous tax reform, which refers to tax cuts and changes in tax laws that may encourage or discourage productive behavior. Answer and Explanation:

Supply-side fiscal policy works by giving incentives to business to expand.

A corporate tax cut gives businesses more money to hire workers, invest in capital equipment and produces more goods and services.

Supply-siders claim that this greater growth will make up for the lost tax revenue.

What is the main goal of the supply-side fiscal policy

According to supply-side economics, consumers will benefit from greater supplies of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices.supply-side economics, theory that focuses on influencing the supply of labour and goods, using tax cuts and benefit cuts as incentives to work and produce goods. It was expounded by the U.S. economist Arthur Laffer (b. 1940) and implemented by Pres. Ronald Reagan in the 1980s.Keynesian economists believe that the primary factor driving economic activity and short-term fluctuations is the demand for goods and services. The theory is sometimes called demand-side economics. Keynesians believe that the solution to a recession is expansionary fiscal policy, such as tax cuts to stimulate consumption and investment, or direct increases in government spending, either of which would shift the aggregate demand curve to the right.

What are the 4 supply-side policies : Examples of supply side policies include reducing taxes on businesses and individuals, reducing regulation and bureaucracy, investing in education and training, promoting free trade, and encouraging research and development.

What are the 3 supply-side policies : There are three categories of market-based supply-side policies: Encouraging competition. Labour market reforms. Incentive-related policies.

What are the three supply-side policies

Free market supply-side policies are policies that encourage competition, market reform, and create incentives. Examples of free-market policies are privatisation, deregulation, and trade liberalisation. Encouraging globalized free trade via containerization is a major recent example. Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.The limitation of supply-side policies for economic growth can be: 1) Supply-side policies can take huge time to make its way through the economy. For example, improving human capital through education and training do not give quick results. 2) The supply-side polices are very costly to implement.

Why are supply side policies : Supply-side policies are policies that aim to increase productivity and efficiency in the economy. The objective of supply-side policies is to boost aggregate supply (AS) to result in increased output. In this case, the LRAS shifts to the right and national output levels increase, meanwhile the price level decreases.

Antwort Does fiscal policy have supply side effects? Weitere Antworten – Is fiscal policy demand-side or supply side

In addition to fiscal policies, monetary policies are also known as demand-side policies.Fiscal policy influences the economy through government spending and taxation, typically to promote strong and sustainable growth and reduce poverty.In supply-side economics, the goal is to provide consumers with more products and service options to purchase by encouraging businesses to spend money on production and research. In contrast, demand-side economics focuses on helping consumers maximize their income by reducing taxes to spend more on goods and services.

What are the differences between Keynesian and supply side fiscal policies : This is the single big distinction: a pure Keynesian believes that consumers and their demand for goods and services are key economic drivers. In contrast, a supply-sider believes that producers and their willingness to create goods and services set the pace of economic growth.

Which of the following is a supply-side fiscal policy that could

The tools that are used in the supply-side fiscal policy are the reduction of taxes and deregulation. These tools create a better environment for business since the firms that embrace them can employ more workers hence increasing production; this initiates more demand, which, in return, boosts the economy.

Which is a supply-side policy : Supply-side policies are policies that aim to increase productivity and efficiency in the economy. The objective of supply-side policies is to boost aggregate supply (AS) to result in increased output. In this case, the LRAS shifts to the right and national output levels increase, meanwhile the price level decreases.

Supply Side Policy (SSP) refers to measures governments take to increase the availability or affordability of goods and services, along with generous tax reform, which refers to tax cuts and changes in tax laws that may encourage or discourage productive behavior.

Answer and Explanation:

What is the main goal of the supply-side fiscal policy

According to supply-side economics, consumers will benefit from greater supplies of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices.supply-side economics, theory that focuses on influencing the supply of labour and goods, using tax cuts and benefit cuts as incentives to work and produce goods. It was expounded by the U.S. economist Arthur Laffer (b. 1940) and implemented by Pres. Ronald Reagan in the 1980s.Keynesian economists believe that the primary factor driving economic activity and short-term fluctuations is the demand for goods and services. The theory is sometimes called demand-side economics.

Keynesians believe that the solution to a recession is expansionary fiscal policy, such as tax cuts to stimulate consumption and investment, or direct increases in government spending, either of which would shift the aggregate demand curve to the right.

What are the 4 supply-side policies : Examples of supply side policies include reducing taxes on businesses and individuals, reducing regulation and bureaucracy, investing in education and training, promoting free trade, and encouraging research and development.

What are the 3 supply-side policies : There are three categories of market-based supply-side policies: Encouraging competition. Labour market reforms. Incentive-related policies.

What are the three supply-side policies

Free market supply-side policies are policies that encourage competition, market reform, and create incentives. Examples of free-market policies are privatisation, deregulation, and trade liberalisation.

Encouraging globalized free trade via containerization is a major recent example. Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.The limitation of supply-side policies for economic growth can be: 1) Supply-side policies can take huge time to make its way through the economy. For example, improving human capital through education and training do not give quick results. 2) The supply-side polices are very costly to implement.

Why are supply side policies : Supply-side policies are policies that aim to increase productivity and efficiency in the economy. The objective of supply-side policies is to boost aggregate supply (AS) to result in increased output. In this case, the LRAS shifts to the right and national output levels increase, meanwhile the price level decreases.